Attention! You Should Start Investing Like This

- Establish an individual retirement account as soon as possible

If you are 18 years old or older and are earning taxable income, you can set up an IRA immediately. You can contribute up to $5500 a year to your retirement fund. This money can start to gain immediately after being invested. The most important thing is that if you wait until you are 65 years old to get the money out, it will be tax-free. If you are just learning to invest and plan to save a sum of money for your retirement, IRA is the best way.

• It is very important to establish an IRA as early as possible. The sooner you start investing, the longer it will take to grow. If you only invest $20000 when you are 30 years old, and then do not invest more money, by the time you are 72, you will have an investment of $1280000 (assuming an annual return of 10%). Wow!

• How does IRA do this? By compounding. The dividends and interest earned from your investment will become a "reinvestment" fund, creating a bigger gold mine for you. This means more dividends and interest, and one cycle goes on. The amount of money you have in your IRA roughly doubles every seven years (assuming a 10% return).

- Invest in your company's pension insurance

Like individual retirement accounts, pension insurance is a retirement savings account. Unlike IRAs, your employer will often help you buy a portion of your pension insurance. This means that if you pay $300 in endowment insurance, your employer will also pay more than $300 to help you make this investment. This mode is most like getting "free money". Use it!

- Consider investing mainly in stocks and buying bonds to diversify your portfolio

From 1925 to 2000, buying stocks was better than buying bonds, with an increase of about 700 every 25 years. This means that if you are looking for a reliable investment, you can stick to investing mostly in stocks. Of course, don't forget to buy some bonds to keep investment diversified.

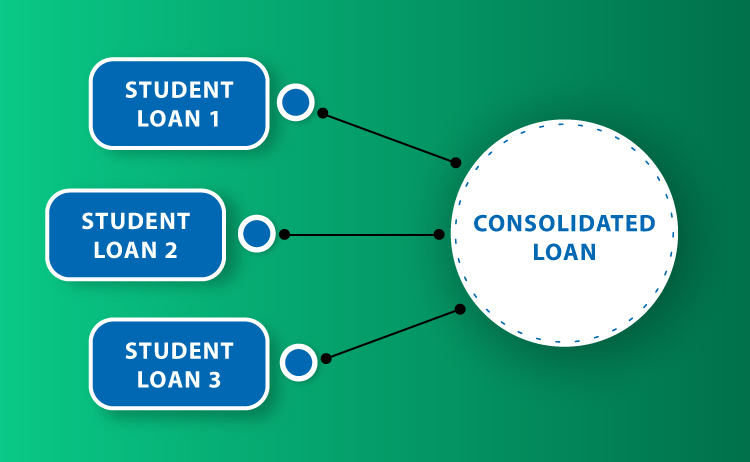

- Start investing a little money in mutual funds and index funds

A mutual fund is a group of securities that investors collect money to buy. Similarly, an index fund is a bundle of securities. Mutual funds and index funds reduce risk by investing less money in many different companies. You can invest in Dow Jones or S&P 500, which will not be much worse.

• Mutual funds are various. They are usually professionally managed, which means that their funds are selected. They can be bond heavy, stock heavy or mixed. They can regularly buy and sell funds, or they can be more or less passive management.

• However, mutual funds are indeed cost linked. When you buy a fund, you need to pay the upfront selling expenses, also known as "load". Then there is the management fee rate (MER), which is calculated by the total assets of the fund. The higher the MER, the more money you need to pay. However, if you invest enough money, these costs should not be too difficult to eat.

- Be sure to insure

There are two reasons why financial insurance is good. First of all, if you happen to lose all the money invested, you will have something to lean on, because you will not lose everything. Second, it will make you a bolder investor, because you don't have to worry about the risk of losing every penny.

• Deposit emergency funds. The emergency fund is usually used for 6-8 months in case of emergency or similar loss of work.

• Purchase other insurance. This can be small items such as car and home insurance, and larger items such as life insurance.

conclusion

You can learn enough investment knowledge from the above and start your investment. The above-mentioned content is just some basic knowledge of investment. If you want to gain a lot of wealth in the market, please learn more about financial management.

(Writer:Dick)