The Impact of the COVID-19 Pandemic on the Global Financial System

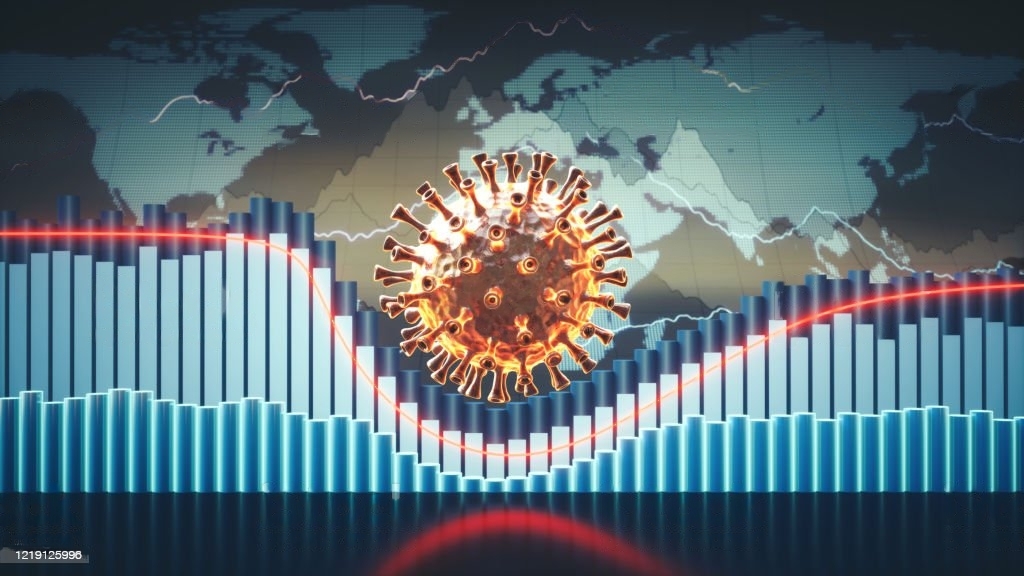

The COVID-19 pandemic has had a significant impact on the global financial system. The pandemic has led to a sharp decline in economic activity, which has in turn led to a decline in demand for loans and other financial services. This has put pressure on financial institutions, which have been forced to raise capital and reduce lending.

The pandemic has also led to increased volatility in financial markets. This has made it difficult for investors to make informed decisions about where to allocate their money. As a result, there has been a decline in investment activity, which has further weakened the global economy.

The COVID-19 pandemic has also exposed some of the weaknesses in the global financial system. For example, the pandemic has shown that the financial system is not well-prepared for a pandemic-like event. The pandemic has also shown that the financial system is too interconnected, which can make it vulnerable to shocks.

The COVID-19 pandemic has had a significant impact on the global financial system. The pandemic has led to a decline in economic activity, increased volatility in financial markets, and exposed some of the weaknesses in the global financial system. The full impact of the pandemic on the global financial system is still unknown, but it is clear that the pandemic will have a lasting impact on the way the global financial system operates.

Here are some of the specific ways in which the COVID-19 pandemic has impacted the global financial system:

Stock markets have fallen sharply. The S&P 500 index has fallen by more than 30% since the start of the pandemic. This has led to a decline in the value of retirement savings and other investments.

Bond yields have fallen. As investors have become more risk-averse, they have sought safety in government bonds. This has led to a decline in bond yields, which has made it more expensive for businesses to borrow money.

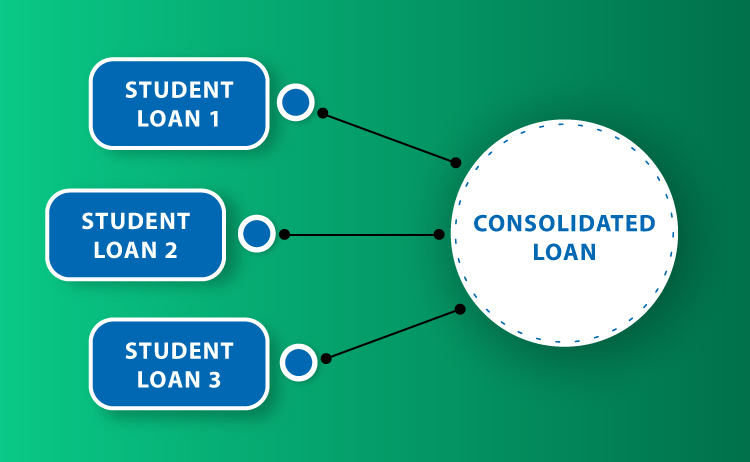

Banks have tightened lending standards. Banks have become more cautious about lending money, as they are concerned about the potential for defaults. This has made it more difficult for businesses and consumers to get loans.

The value of the US dollar has increased. As investors have sought safety in US assets, the value of the US dollar has increased. This has made it more expensive for businesses to import goods and services.

The COVID-19 pandemic has had a significant impact on the global financial system. The full impact of the pandemic is still unknown, but it is clear that the pandemic will have a lasting impact on the way the global financial system operates.

Here are some of the steps that governments and central banks have taken to mitigate the impact of the COVID-19 pandemic on the global financial system:

Governments have provided financial support to businesses and consumers. This has helped to prevent a collapse in economic activity.

Central banks have cut interest rates. This has made it cheaper for businesses and consumers to borrow money.

Central banks have bought government bonds. This has helped to keep interest rates low and stabilize the financial system.

The actions taken by governments and central banks have helped to mitigate the impact of the COVID-19 pandemic on the global financial system. However, the pandemic is still ongoing, and it is possible that the financial system could be further impacted in the future.

Conclusion, the COVID-19 pandemic has had a significant impact on the global financial system. The pandemic has led to a decline in economic activity, increased volatility in financial markets, and exposed some of the weaknesses in the global financial system. The full impact of the pandemic on the global financial system is still unknown, but it is clear that the pandemic will have a lasting impact on the way the global financial system operates.

Governments and central banks have taken steps to mitigate the impact of the pandemic, but the pandemic is still ongoing, and it is possible that the financial system could be further impacted in the future. The COVID-19 pandemic has shown that the global financial system is not immune to shocks.

The COVID-19 pandemic has been a wake-up call for the global financial system. The pandemic has shown that the financial system is not as strong as it needs to be. Governments and central banks need to take action to make the global financial system more resilient to shocks.

(Writer:Tick)