Consolidation Rules And Related Restrictions On Student Loans

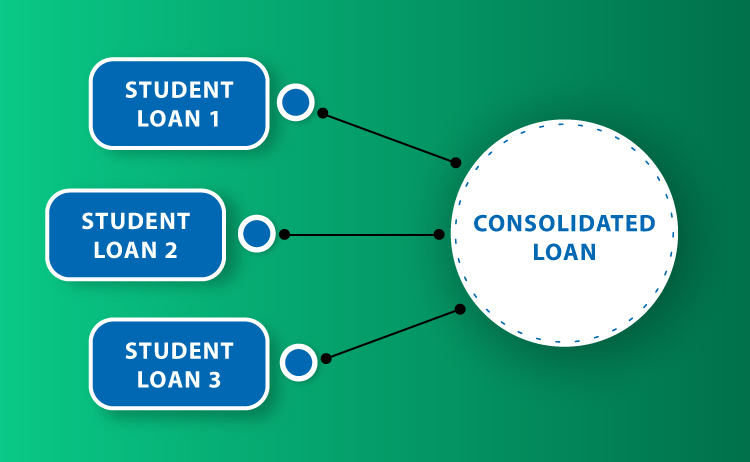

It is very useful for students to combine student loans. This can help students improve their financial situation, and there are advantages in combining multiple federal loans into one loan. Of course, for students, the most useful thing is to simplify the financial situation. You can repay the loan through one payment instead of multiple payments. But in the final analysis, money is still the most important. Loan consolidation can reduce the monthly repayment cost. This is because loan consolidation allows students to have a variety of repayment options, singing about the repayment time, so the monthly repayment cost is almost reduced by half. This will undoubtedly reduce the financial burden of students who have just started to work without obtaining high remuneration. However, this is not unconditional. There are still some rules and restrictions. I will introduce some relevant rules to help you reference.

- Eligibility

You must maintain the liquidity of your existing loans to meet the conditions for applying for a federal loan merger. The most important condition is that you can't break the law and commit crimes. If you are a criminal, unfortunately, you may be able to meet the conditions one day, but not now. For detailed information, I suggest you consult the loan institution to find out what steps should be taken to obtain the qualification for loan consolidation. If you are a full-time student, you are not qualified. Of course, if you are a part-time student, you can study in school and obtain the qualification of loan combination.

- Private loans cannot be combined with federal loans

According to relevant regulations, federal loans cannot be combined with private loans. What is a private loan? Your car loan and even your credit card bill are not eligible for consolidation. Then why can't we merge? First of all, we understand the principle of federal loans. Federal loans provide students with full loans. If students cannot repay the loans, the government will help them repay them. Then the government will ask students to repay, which is called government guarantee. However, private loans do not have the same government guarantee, so the two types of loans are different in nature, so they cannot be combined.

- Student loans belonging to married couples cannot be combined

If a couple applies for a student loan, it cannot be merged. Generally, couples have low flexibility to deal with debts. Even in private loans, these are not problems, but there is some trouble with federal loans, so this practice is also prohibited. Correspondingly, however, couples can apply for a joint bill, which allows them to make one payment for two loans.

- Cannot merge again

If you have used the qualification of loan consolidation in the past, you may not be eligible for re consolidation. Also, if you had previously combined federal loans with other loans, it would probably have been worse. However, if you have a new loan and have not participated in the loan merger, you can still merge.

- Payment Option

The common way of loan repayment is to specify the amount of repayment each month according to a certain period, so that the borrower can repay at a specified time each month. This is the most common way. However, there is also a variable payment option based on income. It is more humanized to pay according to your own income.

(Writer:Weink)